Im sure you guys have all heard by now that the US was downgraded from AAA to AA+ and caused the markets to plummet.

I remember coming on NewWinnipeg suggesting that people buy Gold when it was around $900 -$1000 and everyone was saying its too high and that I was crazy.

:ewwTROLL:

Well now its @ $1770 and not slowing down.

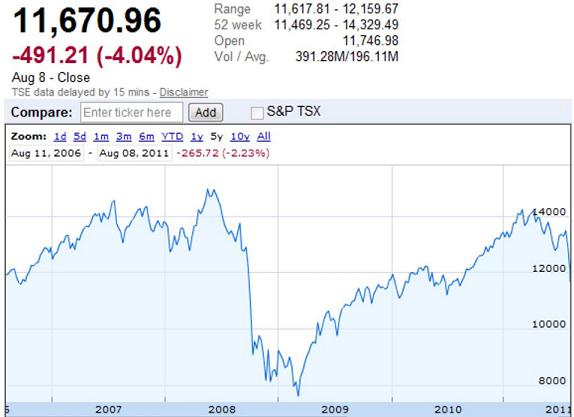

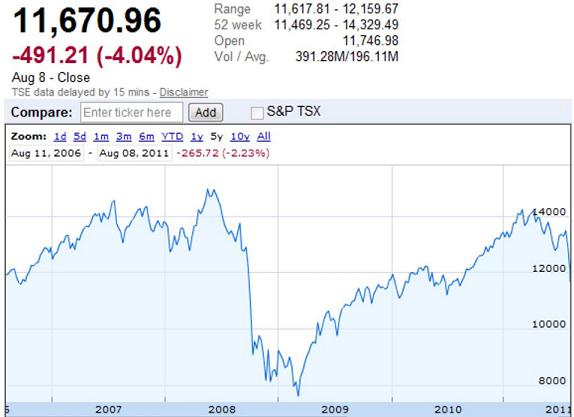

If you held on to TSX stocks from 2006 for the past 5 years right through 2008 and until now, your down 2% while gold is up 200%!

TSX in 2006 was 12000 and today its back to 11600

While Gold in 2006 was $600 and now its almost $1800!

Now please tell me im crazy again....

oh, and the Dow futures are down 250 right now, so expect another mudslide tomorrow!

https://www.youtube.com/watch?v=3CquMO3vJvo

I remember coming on NewWinnipeg suggesting that people buy Gold when it was around $900 -$1000 and everyone was saying its too high and that I was crazy.

:ewwTROLL:

Well now its @ $1770 and not slowing down.

If you held on to TSX stocks from 2006 for the past 5 years right through 2008 and until now, your down 2% while gold is up 200%!

TSX in 2006 was 12000 and today its back to 11600

While Gold in 2006 was $600 and now its almost $1800!

Now please tell me im crazy again....

oh, and the Dow futures are down 250 right now, so expect another mudslide tomorrow!

https://www.youtube.com/watch?v=3CquMO3vJvo